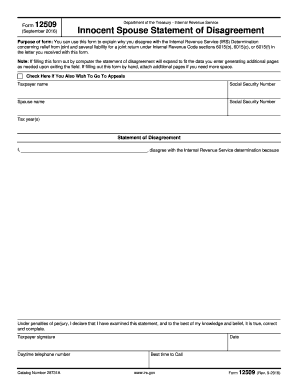

IRS 12509 2005 free printable template

Instructions and Help about IRS 12509

How to edit IRS 12509

How to fill out IRS 12509

About IRS 12 previous version

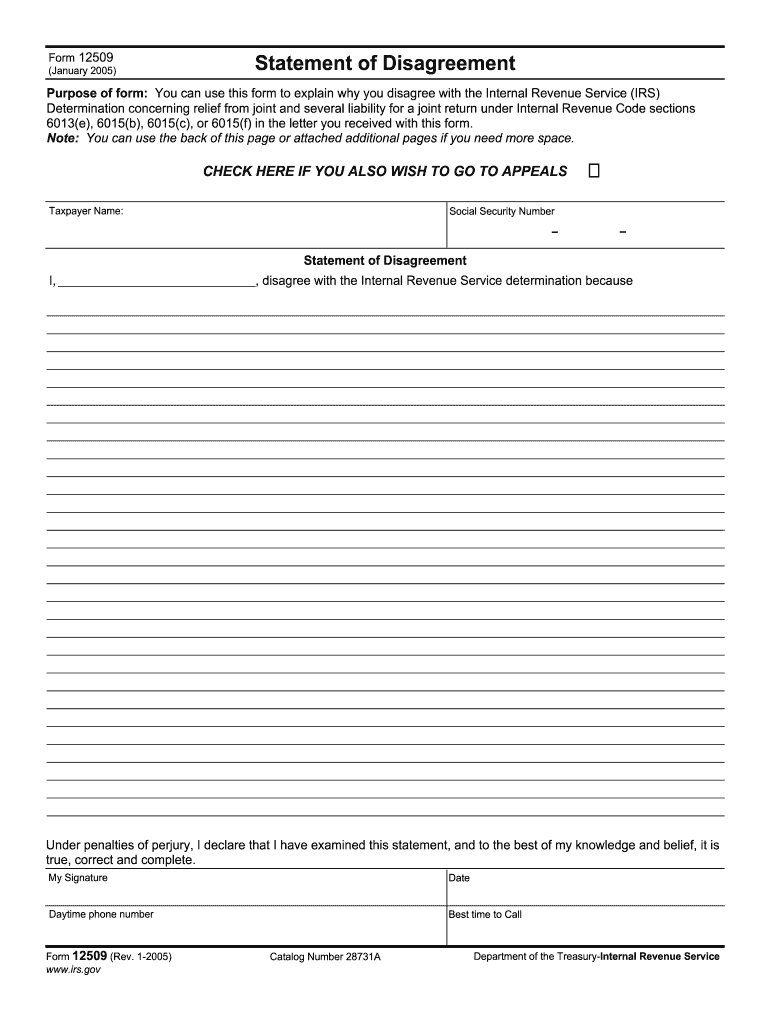

What is IRS 12509?

Who needs the form?

Components of the form

What information do you need when you file the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 12509

What should I do if I realize I made an error on my submitted form disagreement 2005?

If you identify an error on your form disagreement 2005 after submission, you should file an amended form to correct the mistake. Ensure that you clearly note ‘Amended’ on the new form and include accurate information. It’s important to submit the correction as soon as possible to avoid complications.

How can I verify the status of my form disagreement 2005 after submission?

To check the status of your submitted form disagreement 2005, you can use the online tracking system provided by the relevant agency. This tool allows you to see if your form has been processed or if there were any issues with your submission.

Are there specific common errors to be mindful of when submitting form disagreement 2005?

Yes, common errors when submitting form disagreement 2005 include incorrect taxpayer identification numbers and mismatched information. Ensure all details are consistent and verify the information before submission to minimize any potential rejections.

How does submitting form disagreement 2005 electronically affect record retention and privacy?

When you submit form disagreement 2005 electronically, it's essential to keep a record of your submission and confirmation. E-filing typically offers a secure way to store your data, but you should retain copies for your records in compliance with legal requirements for data retention.

See what our users say